|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding 15 Year Refinance Rates in Massachusetts: A Comprehensive GuideRefinancing your mortgage can be a strategic financial move, especially with the option of a 15-year refinance. In Massachusetts, homeowners often explore this to reduce interest payments and pay off their mortgage faster. This guide will provide insights into how it works, its benefits, and considerations. What is a 15-Year Refinance?A 15-year refinance involves replacing your current mortgage with a new one that has a 15-year term. This can significantly reduce the total interest paid over the life of the loan compared to a 30-year mortgage. Benefits of a 15-Year Refinance

Considerations Before RefinancingBefore deciding to refinance, consider your financial situation. Higher monthly payments can strain your budget, so ensure it's affordable. It's also important to consider the refinancing costs and whether the long-term savings outweigh these initial expenses. How to Qualify for a 15-Year RefinanceQualifying for a 15-year refinance in Massachusetts involves a few critical steps:

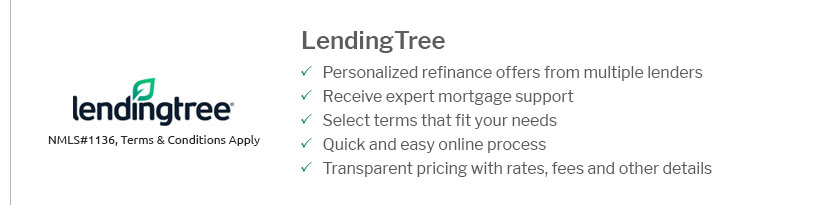

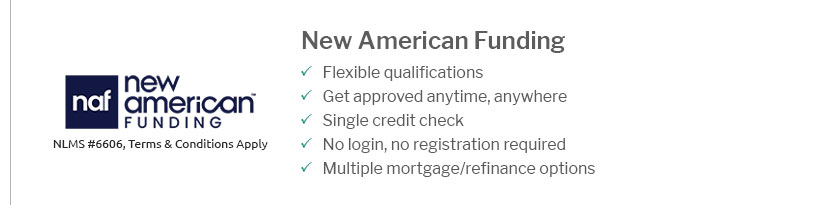

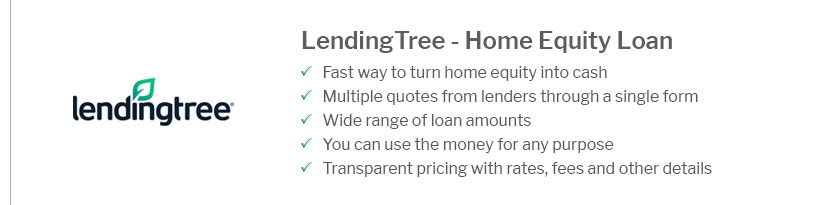

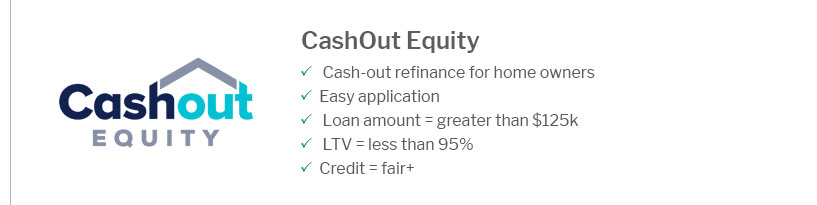

For those concerned about credit issues, explore options with bad credit home refinance lenders who specialize in working with varied credit profiles. Comparing Lenders and RatesIt is crucial to compare offers from multiple lenders to find the best 15-year refinance rates. Consider factors such as interest rates, fees, and customer service. For those with unique home types, such as manufactured homes, it may be beneficial to consult experts in bad credit manufactured home refinance for tailored advice. FAQ About 15-Year Refinance Rates in Massachusetts

https://www.zillow.com/refinance/ma/

Additionally, the current average 15-year fixed refinance rate in Massachusetts increased 9 basis points from 5.97% to 6.06% and the current average 5-year ... https://www.bankrate.com/mortgages/mortgage-rates/massachusetts/

As of Friday, January 24, 2025, current interest rates in Massachusetts are 7.00% for a 30-year fixed mortgage and 6.22% for a 15-year fixed mortgage. Refinance ... https://www.nerdwallet.com/mortgages/mortgage-rates/massachusetts

Today's mortgage rates in Massachusetts are 7.049% for a 30-year fixed, 6.157% for a 15-year fixed, and 7.319% for a 5-year adjustable-rate mortgage (ARM).

|

|---|